Financial Services Contact Center Analytics

Consumer and Market Intelligence

Businesses in the financial and banking industries face unique challenges in satisfying customers and adhering to regulations in today’s increasingly digital economy. The most successful institutions find innovative ways to safely and securely gather essential customer information. Voice analytics software is one of the most effective tools for banks and financial service providers because it enables companies to aggregate actionable data regarding their customers and the market as a whole.

What Is Speech Analytics?

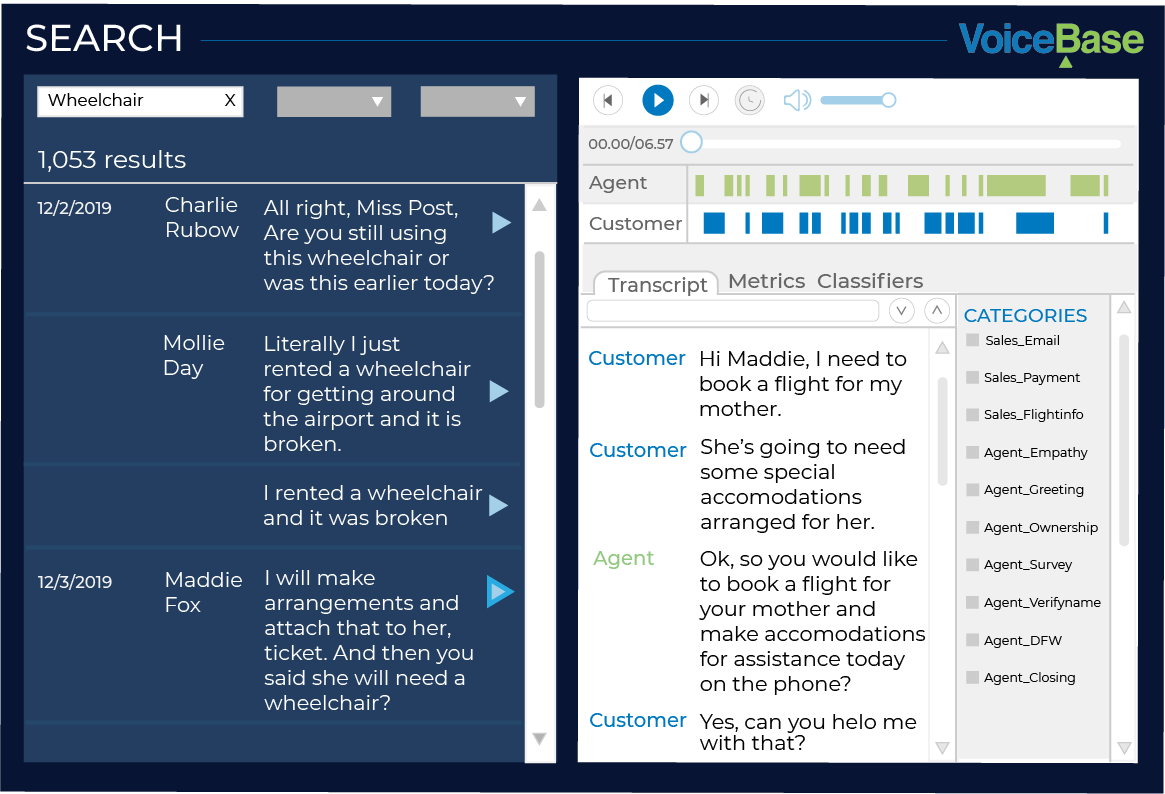

Speech analytics involves several processes that gather and analyze data from customers. In the call center setting, voice analytics involves recording calls and using artificial intelligence (AI) to develop transcripts that detail every word spoken by your customer and service agent during the exchange. Voice analytics software will analyze these transcripts for common themes and keywords. If multiple customers come across the same problem with your mobile site, you’ll know.

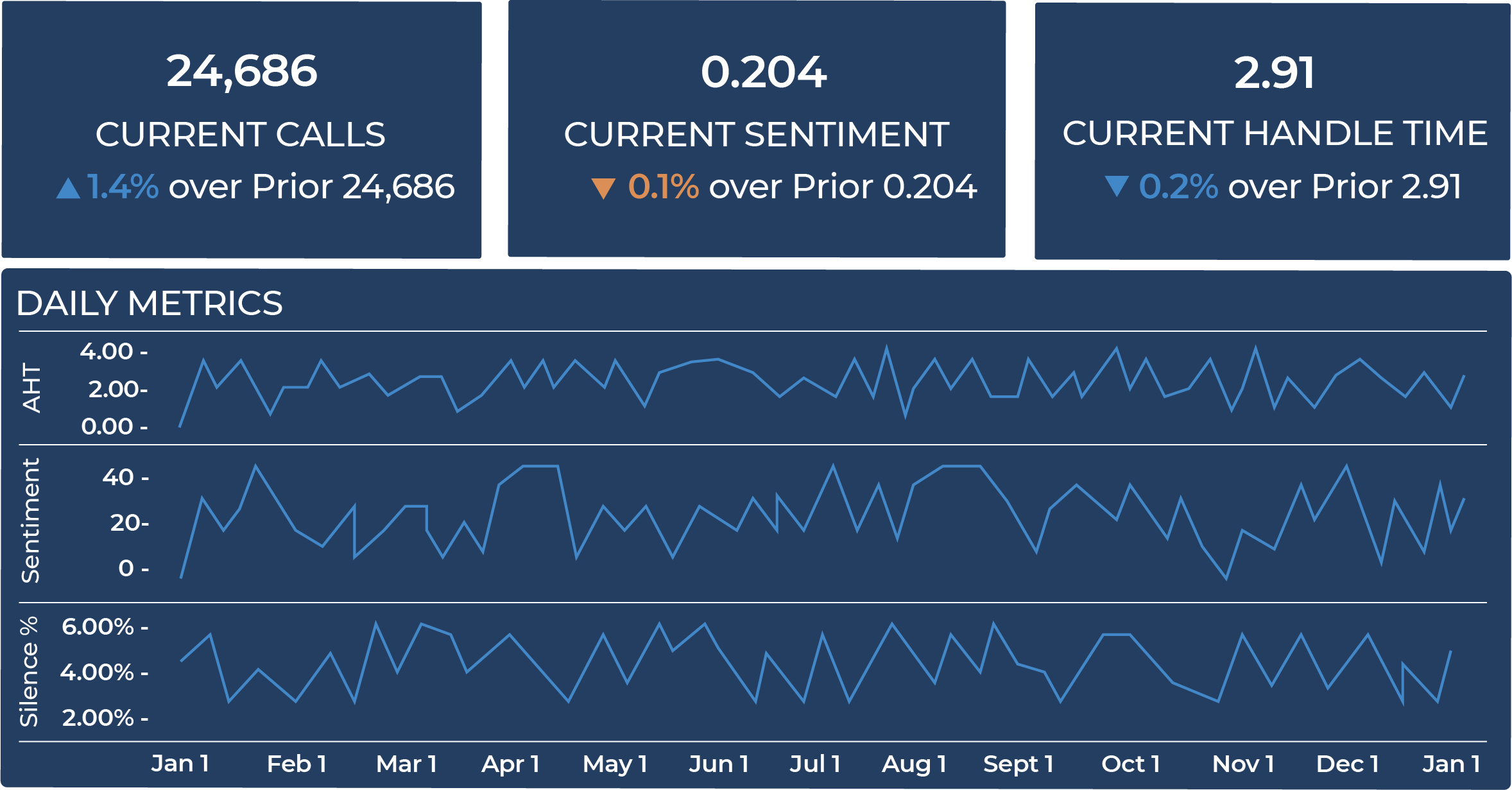

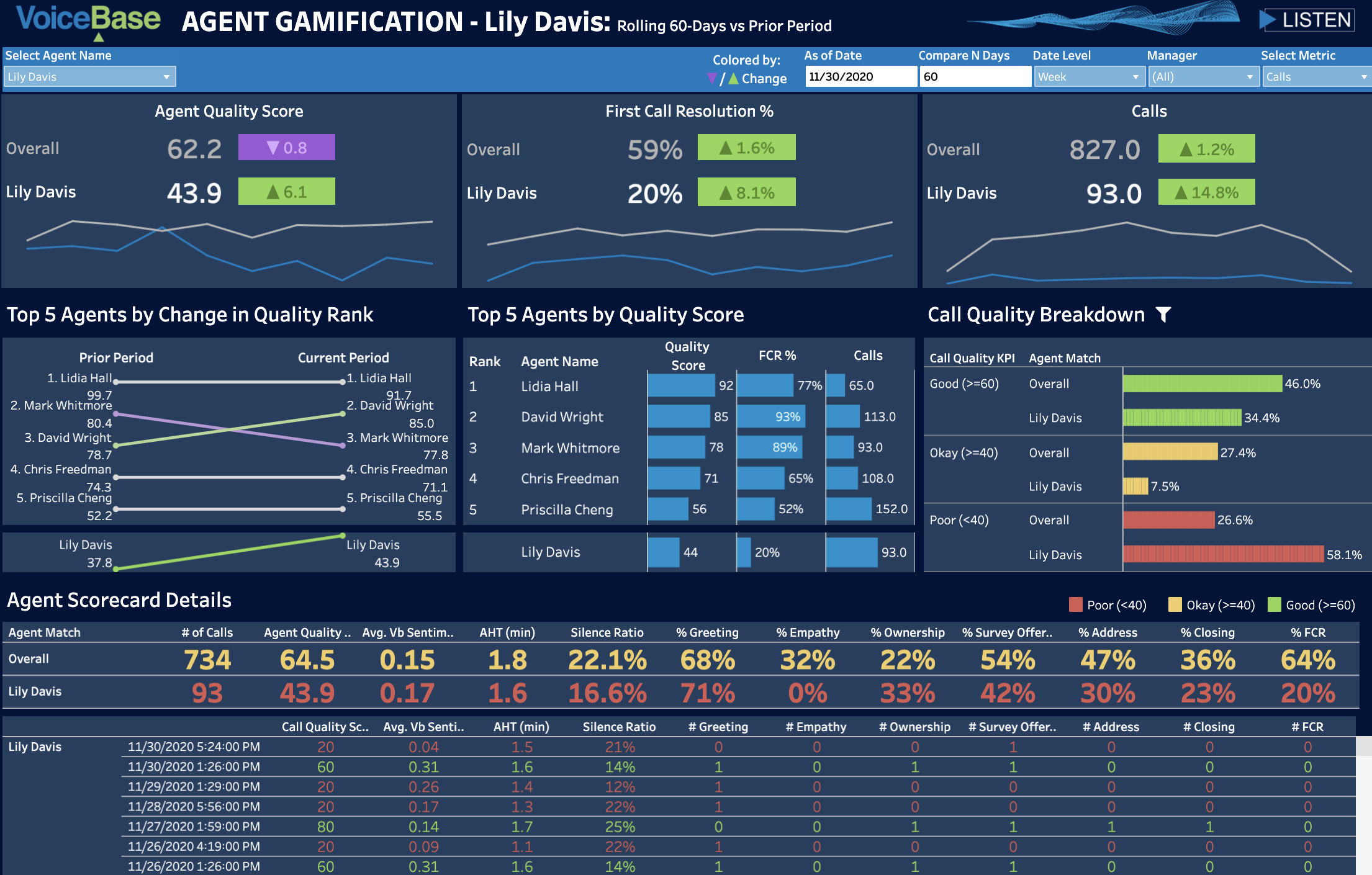

From there, that dataset is shown in charts or other visualization reporting methods to present the aggregated data in a way that’s easy to interpret and share with your team. You can track discussion points in real time or analyze data over a period of months to develop informed plans and monitor your progress. Voice analytics can make a significant difference for your financial institution’s bottom line.

How Banks Will Benefit From Voice Analytics

When you integrate voice analytics software into the workflow of your financial service contact center, you open the door to many benefits that will ensure your success and allow you to navigate the changing technological landscape confidently. Use VoiceBase software to benefit from:

- Enhanced customer experience: Monitoring calls helps businesses get to know their customers and provide them with better, more personalized services. Recorded communication also helps banks quickly verify a customer’s identity, speeding up the call process and taking less time out of their day.

- Ensured regulatory compliance: Voice analytics studies fraud cases to find key phrases and other behaviors that indicate malicious activity. The software will also redact sensitive information like card and Social Security numbers.

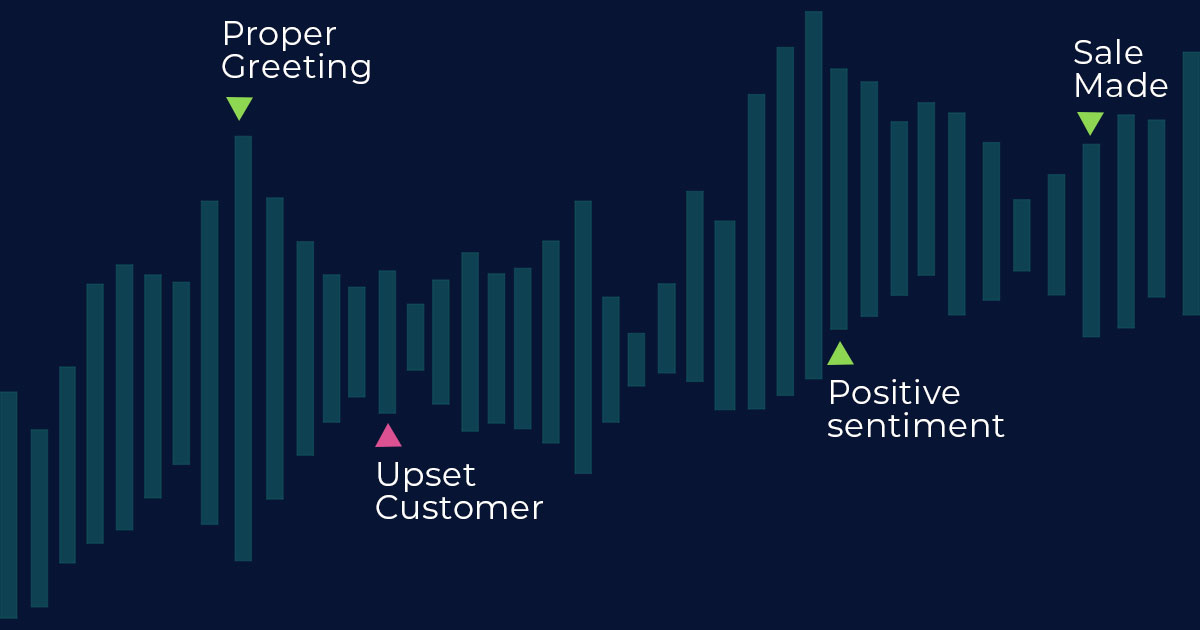

- Improved agent performance: With a database of numerous call scenarios at your disposal, you’ll be able to train your agents to handle any situation, from closing sales to dealing with unhappy customers. You’ll also know which agents are the most successful and stick to their script so you can pinpoint teaching moments for those who are struggling.

- Boosted sales potential: Find the most potent points in the buying process to focus your effort on the moments most likely to result in a conversion. Similarly, optimize your marketing approach by identifying the tactics your customers found most impactful in bringing them closer to a purchase.

- Increased service quality: By gathering massive amounts of customer responses through voice analytics, your financial industry call center will have a clear record of which of your services succeed and fail to meet their needs. You may also discover the services offered by your competitors that caused a former customer to switch, as well as gaps in the market that your team could innovate to fill.

read more on Financial Service Contact Centers

Contact VoiceBase for Tailored Financial Services Speech Analytics

VoiceBase develops voice analytics software designed specifically for your business in the financial industry. To learn more about how you can benefit from bank contact center analytics, get in touch with VoiceBase today!