Insurance CALL Center Analytics Software

QA Every Single Call

When a potential client is interested in your insurance packages and close to making a purchase, they’re likely to reach out to your call center to speak with an agent. The call center interaction is a crucial juncture of the sales funnel, so it’s essential to arm your agents with useful tools to help them make a conversion. In any industry, information is power. Having a substantial database on the factors that lead to conversions can be the difference between making a sale and losing a customer to a competitor.

Call center interactions themselves yield a significant amount of customer data, and modern technological advancements like machine learning and artificial intelligence (AI) make it possible to gather massive amounts of call center data at a faster rate than ever. At VoiceBase, we develop AI-powered software to perform voice analytics for insurance company call centers that will help your company boost sales figures and secure long-term growth.

How Can Voice Analytics Help Insurance Companies?

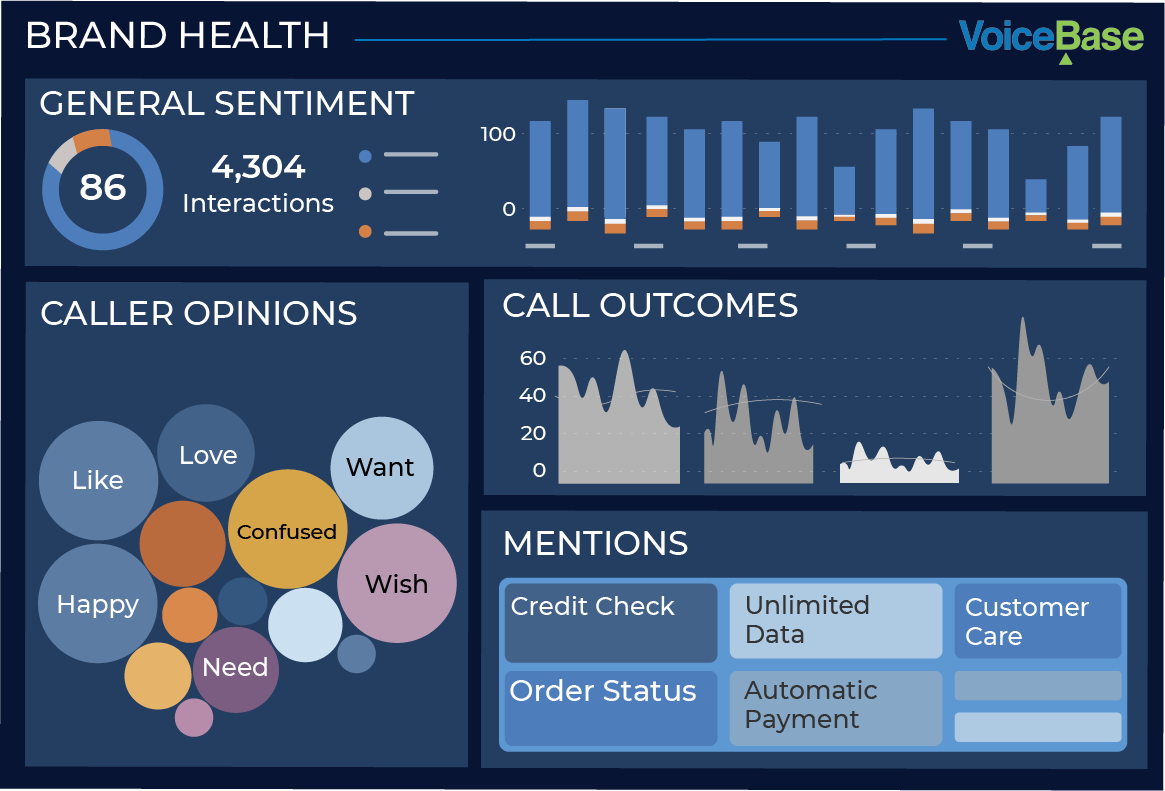

Voice analytics software processes recorded contact center calls and chats and automatically creates transcripts containing every word exchanged between your customer and the agent. It will analyze these transcripts for common themes and present easy-to-interpret data on the findings, allowing your management team to make informed conclusions and develop strategies to drive sales. With a VoiceBase insurance company call center analytics program, you can:

- Retain customers: Speech analytics software can pinpoint the reasons former customers left so your agency can adjust its policies or services to retain clients. The software can even recognize common speech patterns and terms during a call that indicate a customer is considering leaving so your agent can take measures to keep them on board.

- Ensure compliance: Protecting sensitive customer information is vital. Minimize the risk of data breaches and mitigate their harmful effects with our high-quality voice analytics software. VoiceBase software has built-in mechanisms to help insurance agencies comply with all regulating bodies.

- Minimize fraud: It’s possible to catch fraud by analyzing past cases and looking for common indicators. Voice analytics software will help your agents recognize signs of malicious behavior and notify managers to stop imposters in their tracks.

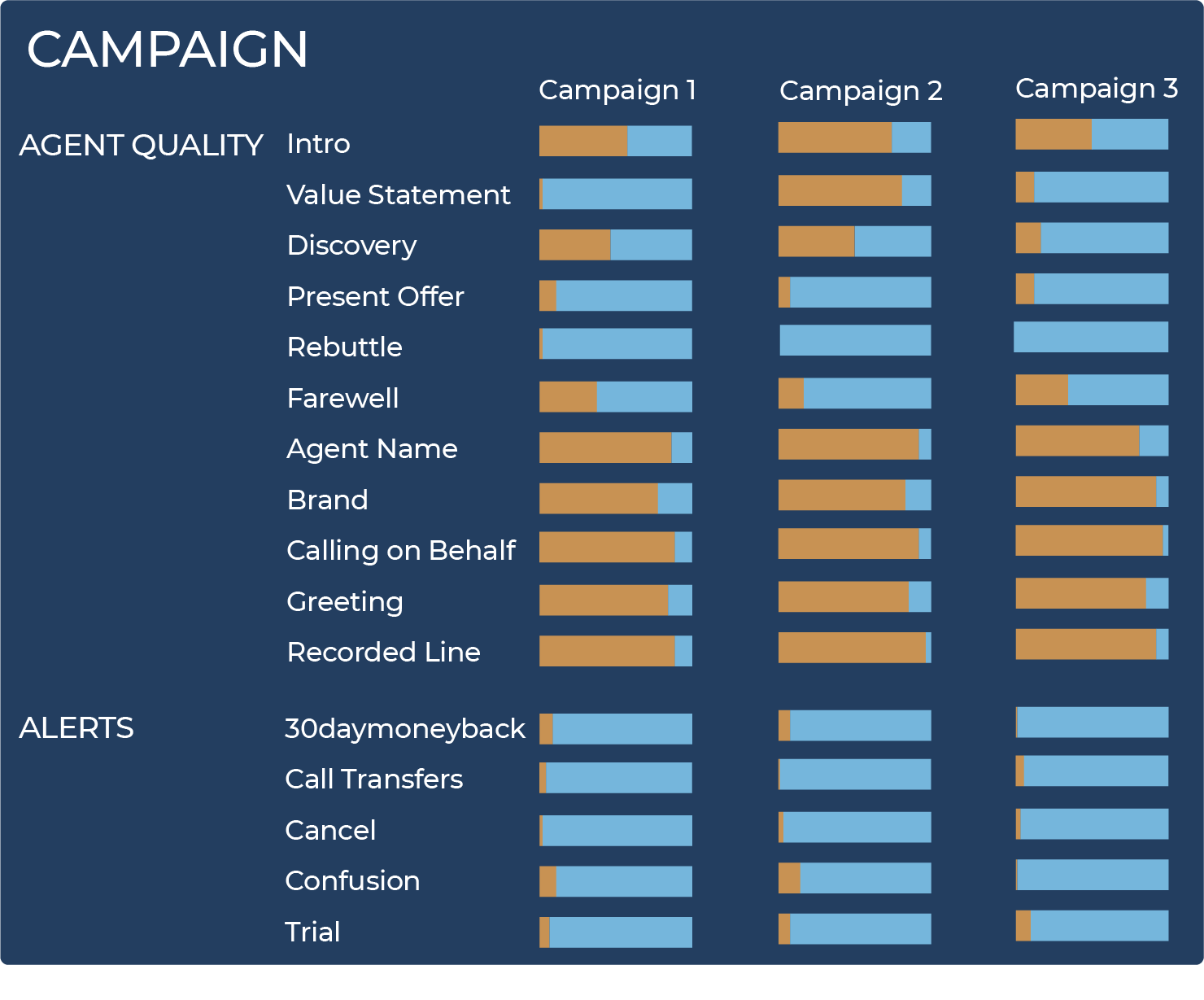

- Improve agent performance: With hundreds of recorded calls at your disposal, you can train your agents to respond to various circumstances. You’ll also be able to see and reward agents who stick to the script and complete conversions while finding teaching moments for struggling staff members.

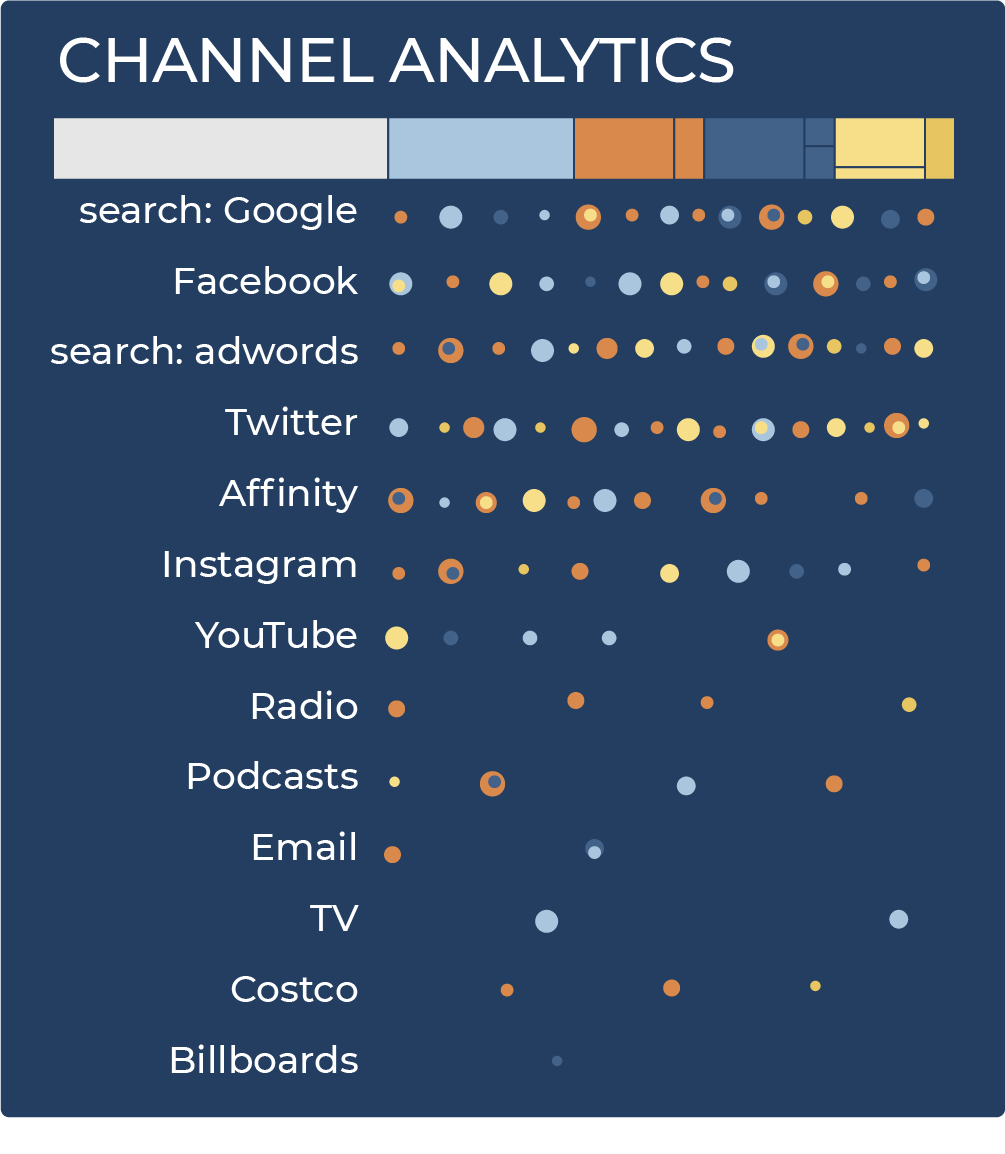

- Upsell policies: Speech analytics for insurance company call centers can pinpoint the customers most likely to purchase and steps in the buying journey most likely to result in a conversion. Your agents can use this information to close sales and upsell the policies that make your company the most profit.

- Improve customer experience: Customers want to work with an insurance company that can promise fast and effective services. Call center analytics will help your agency train your agents to be as helpful as possible to expedite calls. You’ll also find opportunities to improve your policies based on your customers’ needs, your competitors’ offerings or vacancies in the market.

Read more on Insurance Company Contact Centers

Contact VoiceBase for Your Ideal Call Center Analytics Solution

Across every industry, obtaining actionable data enables businesses to further their goals, and great technology makes it possible. For more information on the ways your insurance agency will benefit from call center voice analytics software, connect with a VoiceBase team member today!