Ensure Compliance for Every Interaction

Automated Data Redaction for Call Centers

Protect Customer Data

The Payment Card Industry Data Security Standard (PCI DSS) is a set of standards designed to protect customer data from fraud, theft, and cyber attacks. If your business handles payments, PCI compliance is critical for customer security and protection from large fines for non-compliance.

Don’t Wait for the Audit

Average Cost to a Business After a Breach

IBM Report, 2020

%

Increase in Data Theft Attacks 2019-2020

Protenus Breach Barometer, 2020

%

Of Polled Agents Had Access to Payment Card Data

Payments Journal Report, 2019

Automate Payment Protection with VoiceBase PCI Redaction

Improve call center data compliance with the VoiceBase PCI Redaction, which enables automated detection and redaction of credit card numbers and other sensitive information.

By automating PCI redaction, call center call recordings and transcripts are scrubbed of payment card CVVs, Numbers, and more.

✔️ Credit Card Info

✔️ Social Security Numbers

✔️ Sensitive Data

Search With Confidence

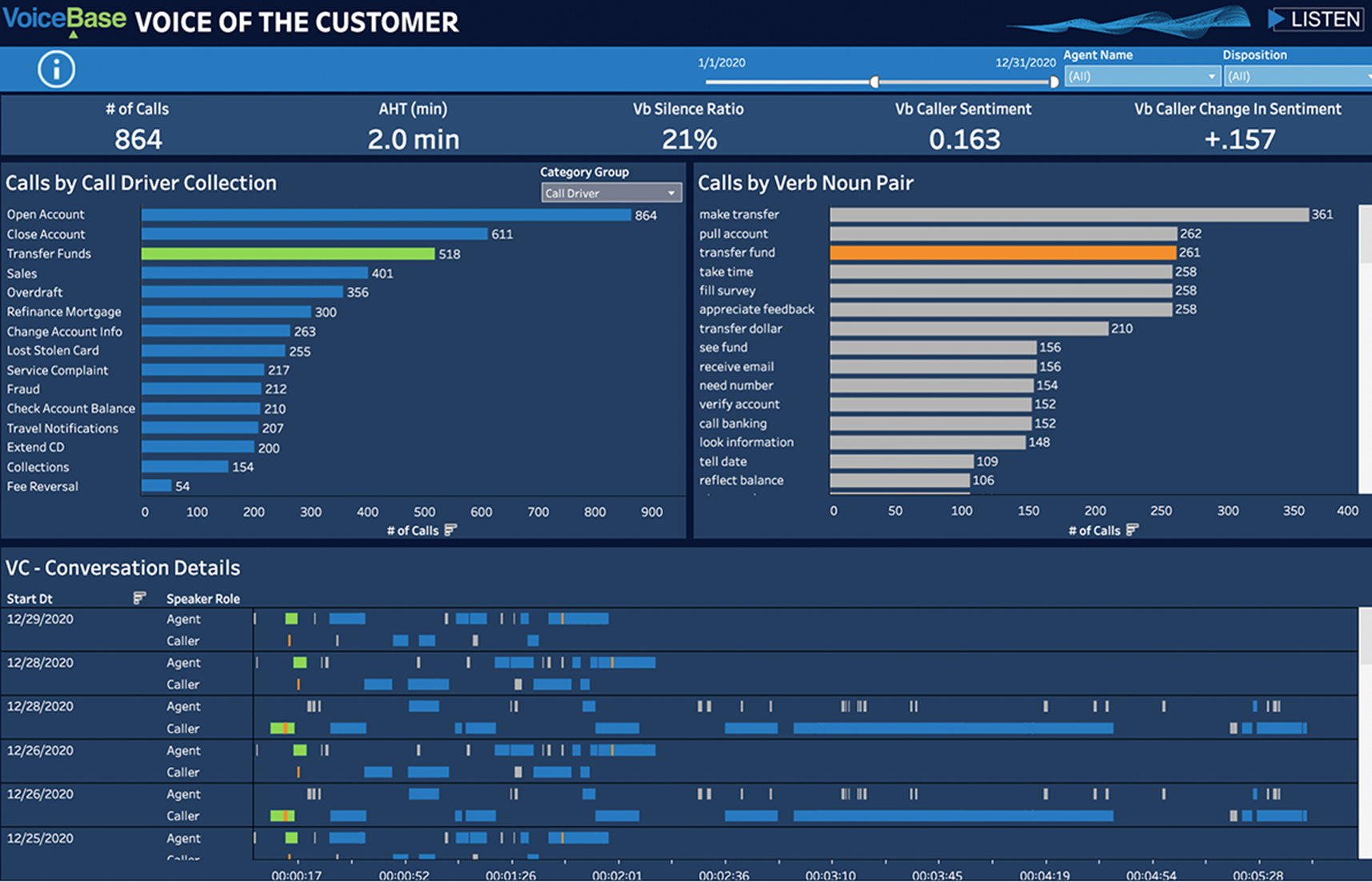

With properly redacted files, you have the freedom to perform unlimited queries and searches across all of your customer interactions. Our PCI DSS Level 1 certification gives you peace of mind when it comes to data security, allowing you to focus on getting the insights you need.

Unlock valuable insights about your customer base though a fully redacted, secure database of call audio files and transcripts.

VoiceBase insights

Optimize Compliant Interactions

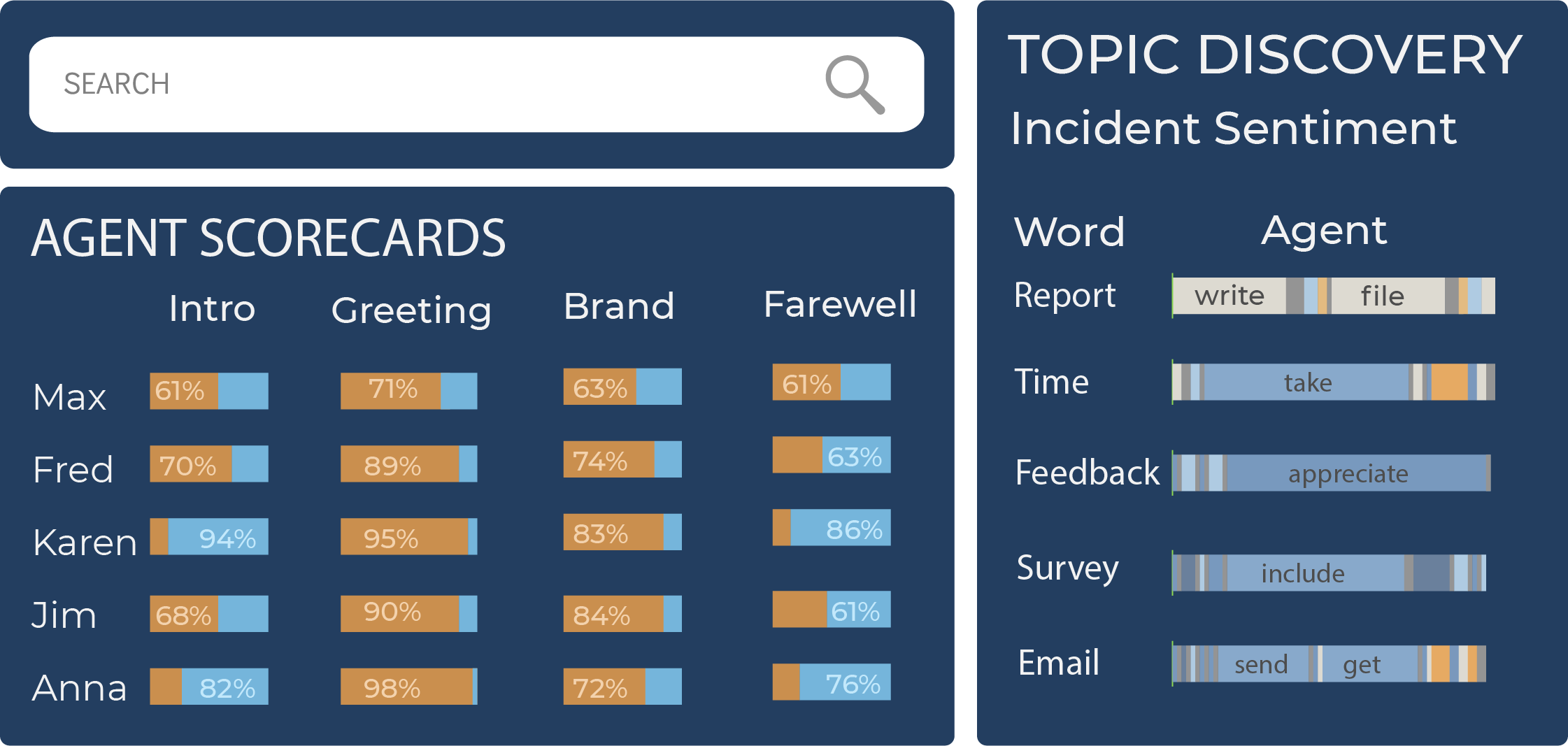

Flag Banned Terms & Keywords

Quickly detect unauthorized behavior from agents and employees, lowering your compliance risk and improving your customer experiences.

Utilize keyword spotting groups and categories to automatically track risky behavior and any potential non-compliance within your call center.

Monitor Every Call

Monitor your calls to ensure agents are using your pre-determined, compliance-ready scripts and confidently follow all rules outlined in the federal consumer protection laws and enforced by the CFPB, the FTC, and the OCC.

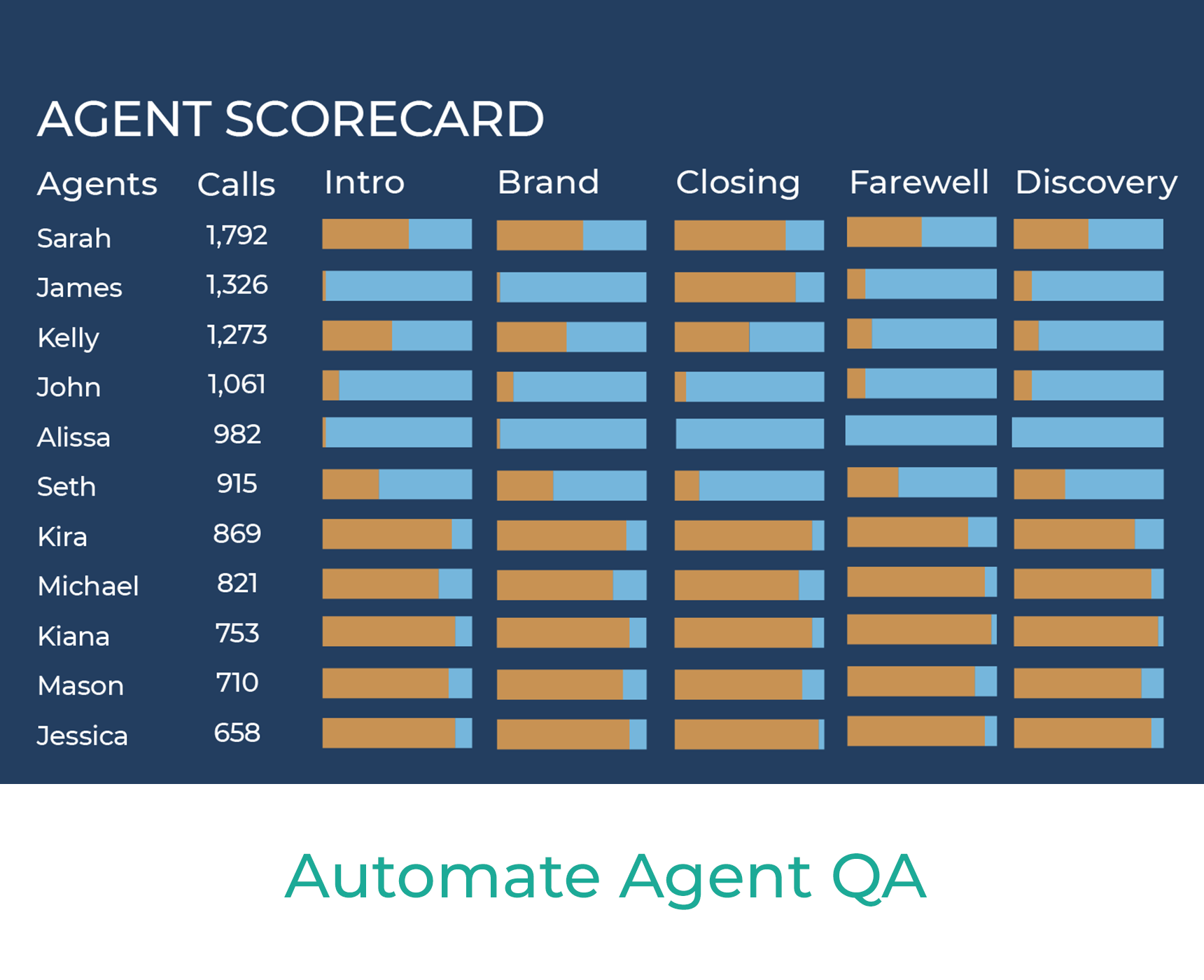

Create Better Scripts For Better Agents

Empower your agents with optimized scripts and improved workforce management. Offer targeted training for agents who struggle with compliance, adjusting scripts and enforcing adherence for the employees who need it most.

Download the Executive Guide to Compliance in the Call Center

PCI-DSS Level 1 Certified

VoiceBase is PCI DSS Level 1 Certified, meeting the highest level of security compliance requirements. Discover highly accurate, secure PCI redaction for call center audio recordings, transcripts, and text conversations.

Powerful Security with PCI DSS Level 1 Certified Technology

What is PCI Compliance?

When it comes to customer transactions, nothing is more important than payment data protection. The Payment Card Industry Data Security Standard, commonly referred to as PCI DSS or PCI-DSS, ensures data security for all consumer payments. By setting requirements for call center data compliance, these standards allow consumers to make purchases without worrying about the security of their credit card information.

Any business or organization that receives, stores, processes, or uses payment information has to follow these standards for full compliance.The 12 PCI DSS requirements ask companies to:

- Install and maintain a firewall configuration to protect cardholder data

- Do not use vendor-supplied defaults for system passwords and other security parameters

- Protect stored cardholder data

- Encrypt transmission of cardholder data across open, public networks

- Use and regularly update anti-virus software or programs

- Develop and maintain secure systems and applications

- Restrict access to cardholder data by business need to know

- Assign a unique ID to each person with computer access

- Restrict physical access to cardholder data

- Track and monitor all access to network resources and cardholder data

- Regularly test security systems and processes

- Maintain a policy that addresses information security for all personnel

The growth of virtual systems has increased the need for strong data security, particularly for credit card and personal information. If your call center processes payment information, these standards are an important part of your contact center compliance.

Why is PCI Compliance Important?

When businesses fail to follow PCI compliance requirements and fall victim to a data breach, millions of people feel the effects. Hackers can gain access to social security numbers, account information, email addresses, payment info, and more for every customer that has made a purchase with that business. By following these rules, companies can ensure peace of mind for businesses, employees, and customers in all industries. Without proper security measures, you may find yourself in danger of losing your customers, compliance, and, ultimately, your business.

The Risks of PCI Non-Compliance

After data loss, public confidence in payment security suffers, impacting every business that handles transactions. Customers lose control of their data, leaving them vulnerable to theft and attacks. They also have to deal with the cost and hassles of getting new credit cards, dealing with potential legal processes, and watching for future damages.

For a business that doesn’t comply with security standards, data breaches carry incredibly high costs, averaging $8.6M for companies in the U.S. You may have to pay card replacement costs, as well as hefty fines. Many companies that experience data losses are subject to investigations and forensic audits to determine the cause and extent of the breach. You can lose your ability to accept payments, effectively destroying your opportunity to make sales. And, once your payment security has failed, your ongoing PCI compliance costs grow even higher.

More importantly, data protection failures can also affect your company’s reputation. Customers may question your ability to keep their information safe, pushing them to use your competitors for their needs. You can lose sales, revenue, and the ability to reach new customers for future growth.

How Does PCI Compliance Work?

The PCI DSS were created by five of the largest credit card companies (American Express, Discover Financial, JCB International, MasterCard Worldwide, and Visa Inc.) in 2006. Though these standards aren’t laws, they are monitored by the PCI Security Standards Council and the credit card brands that consumers use. Each credit card company has unique levels of compliance validation that businesses must meet, proven through the annual completion of either the PCI Compliance Self-Assessment Questionnaire or through a partnership with a certified PCI Quality Security Assessor.

When a company doesn’t comply, credit card brands often fine the company’s acquiring bank for increasing their own risks and potential costs. These fines are typically passed to the company in violation, often accompanied by higher transaction fees and lost contracts.

How Do I Get PCI Compliant?

While all of this information is important, there is a more pressing question: What does it all mean for me?

For all companies and contact centers involved with consumer payments, compliance starts with the systems and processes they use to protect customer data. At VoiceBase, we’ve made data security a priority. Our PCI DSS Level 1 certification ensures both compliance and protection for all of our clients and contact centers.

We actively defend your customer payment data, limiting your risks and helping you achieve long-term success. You can enjoy automated PCI compliance, saving time, increasing confidence, and giving you the tools you need to ensure total payment security.

How does PCI Redaction Work?

When customers give their payment information to your call center agents, this data is now accessible by your employees and anyone with access to your system. To eliminate this vulnerability, you can use call redaction software like VoiceBase to automatically remove sensitive data from your records.

Rather than requiring you to learn how to redact credit card numbers, VoiceBase does it for you. Our cloud-based speech analytics and audio redaction software detects the start and end of payment information, redacting data such as:

- Full Track Data

- CAV2/CVC2/CVV2/CID

- PIN/PIN Block

- Primary Account Number (PAN)

- Cardholder Name

- Service Code

- Expiration Date

- Account Numbers

- Social Security Numbers

Using a credit card redaction tool offers confidence for both you and your customers. You can search through your records without worry, knowing your PCI data scrubbing has kept your insights clean and compliant. No matter who is looking through your system, your customer information will never end up in the wrong hands.

Ensuring Workforce Security and Compliance

Along with PCI compliant transcription services, VoiceBase gives you the tools you need to monitor compliance through every interaction. If an agent uses unauthorized wording during a call, for example, your system automatically flags the occurrence so you can address the issue before it causes bigger problems.

When dealing with PCI compliance, your agent scripts are critical to maintaining data security. VoiceBase helps you build compliant scripts with pre-approved wording to limit risky behaviors. If an agent goes off-script, you can use our tool to identify the agent in question. With quick adjustments to your scripting and focused compliance training for these employees, you can ensure every interaction is up to your standards.

Improving Operations and Compliance

Insights are critical to risk assessments and operational improvements. Securing and redacting your data gives you the ability to look through your information without threatening customer security. With our pre-made, customized dashboards, you can quickly monitor and analyze the state of your compliance. From agent non-compliance to flagged keywords, you can access the insights you need to stay on-track.

Ready to take control of your call center PCI compliance? Connect with a VoiceBase expert through the contact form below to discover the ultimate PCI compliance solution.

Read more on VoiceBase Compliance TOOLS

Looking for PCI Compliance Tools?

A VoiceBase expert can help you get started today.